Contents:

The best way to increase revenue is to decrease staff time spent on administrative tasks such as billing, trust accounting or bookkeeping. By reducing staff time on administrative tasks, a law firm can make sure that staff spends more on the most important thing – providing billable services to clients. Legal Assistants, Paralegals, and Attorneys don’t have the expertise or knowledge to efficiently and accurately bill clients and maintain the business’ books. An expert on the subject can perform the same tasks in less time, increasing the firm’s bottom line by reducing money spent on administrative tasks. We also provide consulting services on a project-by-project basis.

Before the post closing trial balance files its first tax return, it must select its method of accounting. Bookkeepers work directly to keep financial records in order at the law firm. However, when a firm fails to separate revenue that covers incurred costs from its actual revenue, its records will not be correct. If a firm does not separate its revenue from incurred costs from their actual revenue, the documents will be inaccurate. When invoices get paid, the costs will be incurred first. The expenses are not income, so they need to get logged separately.

If you cannot answer these questions to your own satisfaction, we can help. Regardless of the size of your law firm — even if you’re a solopreneur — it’s important to know accounting and bookkeeping basics. By learning the fundamentals of accounting, you can make sure your firm is compliant with ethics rules while finding ways to optimize your cash flow. To keep things even more streamlined, consider using online payment software together with legal accounting software. For example, if you were using LawPay to collect payments and invoice clients, you could easily sync all your transactions into QuickBooks for easy reporting and reconciliation.

Three-way reconciliation

Accountants use financial data to analyze, interpret, and create a summary for you. Treating your customers like the professionals they are is essential if you want to earn and keep their loyalty. You can do this by developing personalized service plans catering to each law firm client’s unique needs and requirements.

Jim Jordan’s main defense of Trump felonies burned to the ground … – msnNOW

Jim Jordan’s main defense of Trump felonies burned to the ground ….

Posted: Mon, 10 Apr 2023 07:00:00 GMT [source]

It is too easy to put the funds in the wrong bank account, mismanage an account, accidentally use funds that need to be saved, or fail to report it correctly. Making mistakes with trust accounting can lead to penalties, suspension, or the loss of the right to practice law. While you spent most of your life becoming a seasoned lawyer, accounting is a different area and not your expertise.

Accountant or CPA

The difference is, the interest earned in a lawyers’ trust account is directed to the state IOLTA board to be used toward advancing legal services and non-profits. Two core tasks of a legal bookkeeper include data entry and bank reconciliation. To do this, legal accountants capture expenses, provide financial forecasting, and prepare financial statements. Without a trusted bookkeeper for attorneys, a legal accountant won’t have any data work off of. And while you learned the ins and outs of the legal system in law school, they didn’t teach you about accounting and bookkeeping.

How To Start A Bookkeeping Business (2023 Guide) – Forbes

How To Start A Bookkeeping Business (2023 Guide).

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

As a result, bookkeepers who work with law firms can expect to work with highly professional and respectful clients who value their services. Attorneys are professionals who know the pain of getting documents from their clients. If you’re a bookkeeping business owner, you might wonder how to increase your revenue and focus your services on a niche market. One market that has proven highly profitable for bookkeepers is the legal industry, specifically attorneys and law firms. In this blog post, we’ll explore why you should consider converting your bookkeeping business from working with all types of clients to working with only attorneys and law firms.

Billable hours or sending out invoices late, can lead to money leakage. When it comes to key accounting concepts, it’s really about organization. These businesses are in all sorts of industries from advertising to real estate.

Best practices for Law Firm Accounting

As your budget year crawls on, you can adjust numbers to more accurately reflect reality and plan the rest of the year accordingly. See what strategic opportunities you have for reinvestment and plug those into your budget. If you’re trending behind, it is better to know sooner rather than later so you can react accordingly. How many clients owe you money and how much do they owe you? With all the options available, we know it’s difficult to choose which software is the best choice for your firm.

- Speaking of expenses, one of the most common mistakes attorneys make is losing track of business expenses.

- I had the cash in the bank to pay my bills throughout this transition.

- Importance of year-end law firm accounting and being prepared for tax time, it’s relatively easy to procrastinate on getting financials in order until it’s time to file.

- Double-entry accounting can create a balance sheet made of equity, liabilities, and assets.

- Ensure your back office runs as smoothly as your front office.

Instead, revenue is recorded when cash is received, and expenses when they’re paid. Only when the money comes in or goes out is it recognized. Law schools offer little to no training on how to manage these accounts. So, many lawyers go into the field without knowing the best practice surrounding trust accounts and how to manage them.

Actively Manage Your Finances and Financial KPIs

We’ve seen firms using these accounts to hide assets or as a savings account. The reality is that there is no scenario where it’s okay to use your IOLTA in this way. We don’t recommend building your business off the back of your credit card. The interest rates are high, limits are often lower than other forms of credit, and they’re easily mismanaged. After selecting your bank, you want to open the necessary accounts. Those are your business checking, savings, and IOLTA account.

They have their own rules and regulations that vary depending on your jurisdiction. If you mismanage this account, you could face severe consequences, including disbarment. Your checking account is self-explanatory — its primary purpose is managing business revenue. With organized financial data, you can better identify opportunities to reduce your overhead, earn more money, and plan for the future.

And without proper care, it’s easy to slip up and make a dangerous error. You’re responsible for recording the receipt and disbursement of these funds and posting the transactions to the ledger accounts of clients. While you don’t need to familiarize yourself with an accounting encyclopedia, it will pay off to learn some common terms.

Dissecting Charges That Could Arise From the Trump Investigations – The New York Times

Dissecting Charges That Could Arise From the Trump Investigations.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

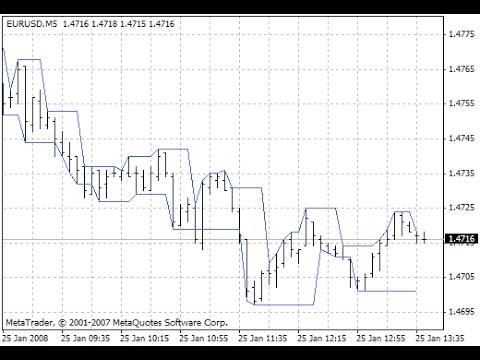

An attorney is required to reconcile their trust bank statement to their client’s individual balance on a quarterly, or even monthly basis. Double-entry bookkeeping or double-bookkeeping accounting is a method that keeps track of where your money comes from and where it’s going. Every financial transaction involves at least two accounts, including debit and credit.

Money leakage occurs when a firm struggles to send out invoices on time, track billable hours, and sending out late invoices. Leaking money happens when money that was supposed to be collected is not due to poor accounting practices. With this picture, you can see opportunities for growth and see options before less organized competitors.

As a solo practitioner or small law firm owner, you have more important things to do with your time than manage your books. The balance in your IOLTA trust bank account must match the amount reflected on your books in the IOLTA trust liability account balance. A general monetary retainer is an amount paid to a lawyer by a client to secure the availability for a specific period time.

Unless exempt, solicitors have six months from the end of their accounting period to obtain an Accountant’s Report. How much are you spending on labor (employees’ salaries, taxes, and benefits) as a percentage of total revenue? – How much profit are you generating as a percentage of your total revenue? The target should be 10-15% with all partners being paid market rate as an expense item.

- CPAs use their expertise and an analysis of your finances to guide you in the right direction when you’re looking to secure a loan.

- I also learned what the owner needs to see in regards to financial reports to run his companies so he can figure out what to change and how to make them grow.

- If for any reason you make a mistake , make sure to track it in your books.

- Regardless of the size of your law firm — even if you’re a solopreneur — it’s important to know accounting and bookkeeping basics.

- Here is my website, and within seconds, you know I only work with attorneys.

As a member of the QuickBooks ProAdvisor Program, we are up-to-date with all the current information and products available to our clients. Anyone looking to use or switch to PC Law Trust Accounting Software must read this review to find out if this software will help them reach their financial goals. Look into the mandatory expenses and resources of your firm. What matters the most is that you have a strategy in your budget that revolves around your business and where you want it to go. Tell everyone you know what you are doing — announce it to the world. Start pumping out blog content or social media content targeting your posts to attorneys.

Practice of keeping client funds given in trust in a separate account from law firm operating funds. We have worked with Neal since the inception of our law firm. We needed a bookkeeper that we could not only trust, but who could turn our financial data into usable information to help us run our law firm more efficiently. He is extremely responsive and individualizes his advice to our law firm’s specific situation. We highly recommend Neal and his bookkeeping and financial analysis services to other small law firms. A chart of accounts is a list of all your firm’s financial accounts, usually used by an accountant and available for bookkeepers.