Land is not depreciable (it doesn’t wear out), but land improvements such as roads, sidewalks or landscaping may be written off over periods of 10, 15 or 20 years depending on the specific nature of the asset. This is a simple way to depreciate the value of an asset based on how frequently the asset is used. “Units of production” can refer to something the equipment makes — like the number of pizzas that can be made in a pizza oven, or the number of hours that it’s in use.

Real Estate Depreciation Strategies Relevant Legislation Updates – EisnerAmper

Real Estate Depreciation Strategies Relevant Legislation Updates.

Posted: Wed, 14 Dec 2022 08:00:00 GMT [source]

To help you figure your deduction under MACRS, the IRS has established percentage tables that incorporate the applicable convention and depreciation method. These percentage tables are in Appendix A near the end of this publication. The 150% declining balance method over a GDS recovery period. The 200% declining balance method over a GDS recovery period. 587 for a discussion of the tests you must meet to claim expenses, including depreciation, for the business use of your home. All property used predominantly in a farming business and placed in service in any tax year during which an election not to apply the uniform capitalization rules to certain farming costs is in effect.

Sandy’s experience working with project companies and tax credits makes her a natural fit in this role. Her role at Rubino has recently been expanded to include the management of nonprofit and for-profit clients. Chanh started his career in tax working for a privately held multibillion-dollar company. He joined a regional public accounting firm in 2004 and has been in public accounting since. He has provided tax compliance, planning, and consulting services to his privately and publicly held business clients in a wide range of industries. Matthew has been in the accounting profession since 2013, with a primary focus on performing audit services for nonprofit organizations and government contractors.

Deductions And Depreciation

The contribution of property to a partnership in exchange for an interest in the partnership. The transfer of property by a corporation that is a party to a reorganization in exchange solely for stock and securities in another corporation that is also a party to the reorganization. The transfer of property to a corporation solely in exchange for stock in that corporation if the transferor is in control of the corporation immediately after the exchange.

In January 2020, Paul Lamb, a calendar year taxpayer, bought and placed in service section 179 property costing $10,000. Paul elected a $5,000 section 179 deduction for the property and also elected not to claim a special depreciation allowance. In 2022, Paul used the property 40% for business and 60% for personal use. Divide the balance by the number of years in the useful life. Unless there is a big change in adjusted basis or useful life, this amount will stay the same throughout the time you depreciate the property. If, in the first year, you use the property for less than a full year, you must prorate your depreciation deduction for the number of months in use.

The property can be devalued at a steady rate for a prescribed period of time, which, as of 2011, is 27½ years for residences and 39 years for commercial properties. In the same example, the property will depreciate at $10,000 per year until it has no value 27½ years later. Even if the home’s assessed value has tripled during that time period, it is considered worthless to the IRS.

You can have a “Capitalgainon depreciable property if you sell it for more than its adjusted cost base plus the outlays and expenses incurred to sell the property” . But, “A loss from the sale of the depreciable property is not considered to be a capital loss. Depreciable assets are considered a part of the activities of your business and property; therefore, they are better integrated with your business or property through tax depreciation and Terminal Losses than as a Capital Loss.

The Section 179 Deduction

Other events that can require an adjustment to the basis are casualty losses for which you’ve claimed a tax deduction, or additions or improvements to the property. You’ll need to keep a record of these items, too, and save them until you eventually dispose of the property. If the purchase price of property included both depreciable property and non-depreciable property or if you use the property for both business and personal use you are required to allocate the basis. Assume the same facts in Example 2, you may elect to use the straight-line method to claim a depreciation deduction of $200 (10 percent of $2,000) for the first year and $400 (20 percent of $2,000) for the second year. Mid-month convention – The mid-month convention is used only for real estate.

You refer to the public accounting Percentage Table Guide in Appendix A and find that you should use Table A-7a. March is the third month of your tax year, so multiply the building’s unadjusted basis, $100,000, by the percentages for the third month in Table A-7a. Your depreciation deduction for each of the first 3 years is as follows. If you reduce the basis of your property because of a casualty, you cannot continue to use the percentage tables. For the year of the adjustment and the remaining recovery period, you must figure the depreciation yourself using the property’s adjusted basis at the end of the year.

You can depreciate the part of the property’s basis that exceeds its carryover basis (the transferor’s adjusted basis in the property) as newly purchased MACRS property. Instead of using the above rules, you can elect, for depreciation purposes, to treat the adjusted basis of the exchanged or involuntarily converted property as if disposed of at the time of the exchange or involuntary conversion. Treat the carryover basis and excess basis, if any, for the acquired property as if placed in service the later of the date you acquired it or the time of the disposition of the exchanged or involuntarily converted property. The depreciable basis of the new property is the adjusted basis of the exchanged or involuntarily converted property plus any additional amount you paid for it. The election, if made, applies to both the acquired property and the exchanged or involuntarily converted property.

TURBOTAX ONLINE GUARANTEES

Melanie has over 25 years of professional taxation experience. Having begun her career as a revenue agent with the Internal Revenue Service, she brings a unique perspective on taxation to clients. She assists a wide variety of clients including passthrough entities, C Corporations, sole proprietorships, individuals, trusts, and estates. Melanie also has expertise in multi-state organizations and tax dispute resolution.

MACRS provides three depreciation methods under GDS and one depreciation method under ADS. However, a qualified improvement does not include any improvement for which the expenditure is attributable to any of the following. 50% or more of the gross revenues generated from the property are derived from petroleum sales. A substantial portion of these contracts end with the customer returning the property before making all the payments required to transfer ownership.

File

The FMV of each employee’s use of an automobile for any personal purpose, such as commuting to and from work, is reported as income to the employee and James Company withholds tax on it. This use of company automobiles by employees, even for personal purposes, is a qualified business use for the company. Qualified business use of listed property is any use of the property in your trade or business. Treat the use of listed property for entertainment, recreation, or amusement purposes as a business use only to the extent you can deduct expenses due to its use as an ordinary and necessary business expense. To determine whether the business-use requirement is met, you must allocate the use of any item of listed property used for more than one purpose during the year among its various uses. A passenger automobile is any four-wheeled vehicle made primarily for use on public streets, roads, and highways and rated at 6,000 pounds or less of unloaded gross vehicle weight .

She also has helped organizations put in best practices in accordance with federal laws and governing state legislation. Elaine performs tax planning services and provides compliance advice for a variety of businesses and individuals in the federal tax area as well as assistance with state tax reporting, IRS audits, and foreign tax matters. Bob is also thoroughly familiar with auditing real estate projects receiving an allocation of Low-Income Housing Tax Credits under Section 42 of the Internal Revenue Code. He has worked with most federal financial assistance programs and Community Development Block Grant Programs. Dave is responsible for managing his diverse tax practice, including high-income individuals, small businesses, estates, and trusts. Current assets – Current assets are assets that are used or disposed of in a year.

If you made this election, continue to use the same method and recovery period for that property. You own a rental home that you have been renting out since 1981. If you put an addition on the home and place the addition in service this year, you would use MACRS to figure your depreciation deduction for the addition.

This is any building or structure, such as a rental home , if 80% or more of its gross rental income for the tax year is from dwelling units. A dwelling unit is a house or apartment used to provide living accommodations in a building or structure. It does not include a unit in a hotel, motel, or other establishment where more than half the units are used on a transient basis. If you occupy any part of the building or structure for personal use, its gross rental income includes the fair rental value of the part you occupy.

Under the stepped-up basis rules for property acquired from a decedent. To qualify for the section 179 deduction, your property must have been acquired by purchase. For example, property acquired by gift or inheritance does not qualify. Also, qualified improvement property does not include the cost of any improvement attributable to the following. The following are examples of a change in method of accounting for depreciation.

Then determine the adjusted cost basis by subtracting any deductions made since you’ve owned the asset, such as the cost of improvements made to the property. To determine the depreciation recapture, subtract the adjusted cost basis from the sale price for the asset. Put simply, while a helpful tool for homeowners and real estate investors, depreciation – which offers a handy way to reduce sums owed at tax time – can also lead to later tax bills. That’s because any gains on the sale of a property will be computed by subtracting the amount of this asset at its lowered depreciation-adjusted cost basis from the total sale price. Allan has been in the accounting profession since 1980 and leads Rubino’s Public Housing Authority audit practice. His industry experience includes public housing authorities and other governmental entities, the affordable housing industry , residential real estate, manufacturing, distribution, construction contractors, and the nonprofit sector.

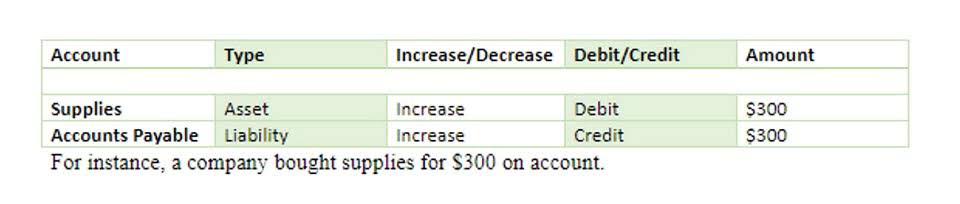

In contrast, the lifespan of office furniture is seven years. The difference between the asset’s cost and salvage value is methodically allocated to depreciation expense over its useful life. Depreciable assets are reported on the balance sheet under the asset heading property, plant and equipment. Depreciation you’d already claimed would be taxed along with your other sources of ordinary income, in this case, in the year the change occurred.

- (Other members of your family do not use this computer.) Therefore, you can depreciate 2/3 of the cost of the computer.

- You multiply the reduced adjusted basis ($58) by 100% to arrive at the depreciation deduction for the sixth year ($58).

- InterNACHI inspectors trained in residential and commercial property inspections can help streamline your purchase.

- The depreciation allowance for the GAA in 2022 is $25,920 [($135,000 − $70,200) × 40% (0.40)].

It also explains how you can elect to take a section 179 deduction, instead of depreciation deductions, for certain property and the additional rules for listed property. The primary difference between the two systems is that MACRS specifies longer recovery periods for depreciable assets, which results in slower depreciation than allowed by ACRS. There is a direct correlation between the useful life of an asset and the size of the depreciation deduction in a given year. And as a general rule, the earlier you can claim a depreciation deduction, the greater its present value. This section describes the maximum depreciation deduction amounts for 2022 and explains how to deduct, after the recovery period, the unrecovered basis of your property that results from applying the passenger automobile limits.

A capital expense is a cost you incur to create future benefits. To qualify as a capital expense, an item purchased for your rental property must have a life expectancy of more than 1 year. Rental property owners who believe they must use ADS should consult an accountant to determine the best way to depreciate their property.

Depreciation recapture in the partnership context – The Tax Adviser

Depreciation recapture in the partnership context.

Posted: Mon, 01 Aug 2022 07:00:00 GMT [source]

It includes any program designed to cause a computer to perform a desired function. However, a database or similar item is not considered computer software unless it is in the public domain and is incidental to the operation of otherwise qualifying software. This chapter explains what property does and does not qualify for the section 179 deduction, what limits apply to the deduction , and how to elect it. Depreciation or amortization on any asset on a corporate income tax return (other than Form 1120-S, U.S. Income Tax Return for an S Corporation) regardless of when it was placed in service. If you do not claim depreciation you are entitled to deduct, you must still reduce the basis of the property by the full amount of depreciation allowable.

The depreciation method for this property is the 200% declining balance method. The corporation must apply the mid-quarter convention because the property was the only item placed in service that year and it was placed in service in the last 3 months of the tax year. On December 2, 2019, you placed in service an item of 5-year property costing $10,000.

Kiely Kuligowski is a business.com and Business News Daily writer and has written more than 200 B2B-related articles on topics designed to help small businesses market and grow their companies. Kiely spent hundreds of hours researching, analyzing and writing about the best marketing services for small businesses, including email marketing and text message marketing software. Additionally, Kiely writes on topics that help small business owners and entrepreneurs boost their social media engagement on platforms like Facebook, Twitter and Instagram.