Contents:

Get expert help with accounts, loans, investments and more. Find out whether a letter from your bank is acceptable. Ensuring the ACH Network remains a trusted payment system for all participants. YouTube’s privacy policy is available here and YouTube’s terms of service is available here. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local. Your full guide to understanding what a debit card is and how it works.

Luzerne County’s hand-marked ballot plan dissected – Wilkes Barre Times-Leader

Luzerne County’s hand-marked ballot plan dissected.

Posted: Thu, 06 Apr 2023 02:45:00 GMT [source]

A canceled check is one that the bank has already cleared. It means that the check can no longer be used after it has been cashed or deposited. Voided checks can serve an important role in direct deposits and other ongoing transactions. Get a Direct Deposit form / Void Cheque now in EasyWeb.

Get a counter check from your bank

Many banks have a phone line where you can dial up and interact with an automated voice response system, for various customer service tasks. One of the options is something like “merchant check verification”. That option is intended to help a merchant who receives a check to verify whether the person writing the check has enough money in their account for the check to clear. A voided check can be useful for providing the necessary information for certain electronic payments, such as direct debits. A voided check is a check which is no longer valid and has the word ‘void’ written on the front. As such, it’s a check that banks won’t accept for payment.

Even if the message gets deleted promptly, an archived copy of that message might exist for a very long https://1investing.in/. To send a fax, you can visit a local printing or shipping office, or you can use an online service to send a fax from your computer or mobile device. Note that when you upload a document to an online service, that service could get hacked, so an old-fashioned fax might be the most secure solution. One way to solve the problem is to send the check image as an encrypted PDF, which requires the recipient to enter a password before viewing the document. Be sure to provide the password securely, and don’t email it unless you use different email addresses. It’s best to call the recipient and deliver the password verbally, but you also could send the password as a text message.

It has the word “VOID” written across it and therefore is not a blank check either. A voided check will still have your account details on it but it cannot be used to process any payment. Voiding a check helps ensure others can’t cash or deposit money from your account. Because checks have important bank information on them, it’s important to make sure they’re voided correctly when you don’t want them being used. You can also request a stop payment order through your online banking web portal.

Can you make a void check online?

The most important thing is to be sure that it cannot be erased or obscured in any way. You should be able to withdraw the $100 you still have in the bank and give them that much. While they will still be out the $20 fee, that should make them feel much better about you as a customer. Tell them when you will be paid and that you will give them the $20 on that date. Now they are threatening me by saying they will go to the police and report me for fraud.

This process allows your employer to deposit your paycheck or expense reimbursements directly. Payment services may also require a voided check when setting up an account. Many employers use direct deposit to pay their employees instead of writing cheques.

If you don’t have a paper check, you can always go to your nearest bank branch and request a voided check. All you need to do is write “void” in large letters across the face of the cheque. Make sure you take up as much space as possible so that someone cannot try to fill it out and use it. These are the account numbers and usually the reason a void cheque is needed.

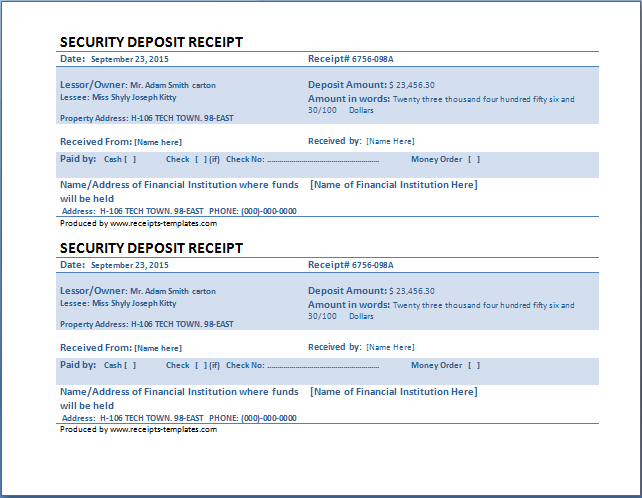

How to Void a Check in Three Steps

If you have been looking into will canceling a credit card stop recurring payments and have decided to pursue that, you will need an ACH payment set up. A void check is a physical check that has been cancelled out and cannot be used for any type of payment. It also contains the word “VOID” printed on it in several locations to portray that this is a cancelled check. The word “VOID” itself can either be printed by electronic means on the check, or also handwritten with a permanent marker. If you don’t have paper checks, you can still enjoy the benefits of direct deposit.

The reason cash and cash equivalentss no longer pay employees with physical checks is because it is too expensive. If you are wondering what someone can do with a voided check there are actually quite a few things. There are a lot of reasons why someone would want to void a check however the biggest reason is that it’s an excellent way to share your banking information quickly. With all of the advantages and disadvantages of online banking, there are a lot of reasons to void checks. Employer’s use a voided check to ensure accuracy when setting up direct deposit. A mistake in either the routing number or the account number can create delays in payment and may lead to other costs.

You could also ask your employer to make an exception for you if you have specific reasons for not providing the check. Or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank, N.A. Or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. By voiding a check, it can no longer be used as payment or to withdraw money.

- Provide the bank representative with all requested information about the check and its payee.

- This makes the cheque void, while allowing an employer or a service that’s setting up auto billing to access the banking information they need to set up direct deposit.

- Instead, turn it into an encrypted or password-protected file or create a link to a file in a protected folder.

- Some mobile banking apps allow you to quickly identify and block fraudulent activity.

- Sometimes voided checks do go through initially as deposits.

- Often, extra savings make the extra effort worthwhile.

The Electronic Fund Transfer Act protects consumers when they transfer funds electronically using debit cards, ATMs, and direct deposits. If you want to pay your mortgage, car loan, or other bills online, then you may have to submit a voided check to schedule payments from your checking account. These scams work because fake checks generally look just like real checks, even to bank employees.

How to Void a Check for Direct Deposit

Then, instead of filling out the cheque as you normally would, you write ‘VOID’ across it in pen or permanent marker. Just make sure that all of the numbers at the bottom of the cheque remain clear as this is the information needed to set up your payments. A void cheque is a cheque that has the word ‘VOID’ written on it in large letters. This renders it invalid and prevents anyone from filling it out, making it out to themselves and/or trying to cash it. At the same time, it still shows the banking information needed for direct deposits or preauthorized payments. ACH payments transfer funds electronically from your bank account to a vendor without the need to write a separate check for each payment.

Get £30 free bets and £10 bonuses when you bet £10 with Betfred – Liverpool Echo

Get £30 free bets and £10 bonuses when you bet £10 with Betfred.

Posted: Fri, 14 Apr 2023 13:51:03 GMT [source]

Yes, those numbers are all that is needed to withdraw funds, or at least set online payment of bills which you don’t owe. Notice that, besides avoiding giving out personal information, her advice is how to deal with problems after they’ve occurred. Your check ordering information will be securely sent to Harland Clarke so you’ll be sure to receive your order on time and without errors. Yes, printing checks from your own printer is perfectly legal. Make sure it includes your account number, account type and routing number — if the recipient just wants your accounts details, that should be enough. But verify from the recipient if this would be acceptable if you have no other options.

Free-agent defensive tackles the Browns could realistically sign – cleveland.com

Free-agent defensive tackles the Browns could realistically sign.

Posted: Mon, 10 Apr 2023 22:09:00 GMT [source]

If you don’t have paper checks, you can still get a check from your nearest bank branch. You can get a voided check by asking a teller to print one for you. There may be a fee for this service, so make sure you ask before you start the process. A voided check is a check that can no longer be accepted as payment from anyone.

- There you have it—that’s everything you need to know about how to void a check.

- If not, they have grounds to open a complaint with law enforcement.

- But if you’re in a pinch after having run out of checks before your new ones arrive, you can often get several instant counter checks from your bank to meet your temporary need.

- To send the check to the recipient you can send it by mail, hand it in person or take a photo and send it by email.

- You want to make it difficult for thieves to erase or cover your void mark.

- Call your bank at the number printed on your check under the institution’s name.

They will not accept the legit check as I have offered to make this situation right, and now basically I’m labeled as a criminal by the liquor store. Make a copy of the voided check for your records, noting the check number. The word “void” should be visible on both sides of a voided check. Rebecca Lake is a journalist with 10+ years of experience reporting on personal finance.